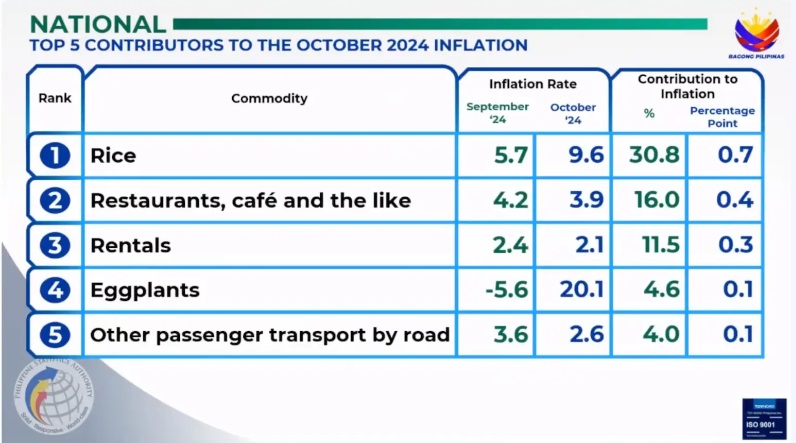

The inflation rate shot up again in October, up to 2.3 per cent from the record-low 1.9 per cent registered in September. More specifically, the increase was driven by the price of rice – a recurring issue of succeeding Philippine governments.

While inflation itself is a headache, as it translates to higher costs of commodities, the problem is especially worse when it comes to rice inflation – given it is a staple for most Filipinos. The prominence of rice is precisely the reason why lowering its cost became a hallmark of President Bongbong Marcos Jr.’ campaign in 2022; making an ambitious pledge to drop its retail price to a mere Php20/kilo.

Not only has Marcos Jr. been unable to come close to this promise, the retail cost of rice has also continued to increase during his term. It would be unfair, however, to pin the blame solely on the sitting president; after all, as mentioned, the cost of price has been an issue for succeeding Philippine governments.

Under Marcos Jr.’s predecessor, former president Rodrigo Duterte, a measure was passed into law that aimed to temper the soaring price of rice in the country. The Rice Tariffication Law of 2019 (RTL) was pushed heavily by the Duterte administration, which promised to lower the retail cost of rice but at the expense of our already struggling rice industry.

The RTL enabled the uninhibited importation of rice, which was expected to push down its retail price by flooding the market with stocks from abroad. This legislation replaced the previous Agricultural Tariffication Act of 1996, that had set a quantitative restriction on yearly rice imports to protect domestic rice farmers.

Instead of limiting the quantity of rice stocks being imported, the RTL will instead slap a 40 per cent tariff on rice imports which would then fund measures to support our already struggling rice industry. This mechanism will raise funds for a Rice Competitiveness Enhancement Fund (RCEF), a funding pool that – in the words of Senator Cynthia Villar, a key proponent of the legislation – “will ensure that [Filipino] farmers become competitive [with their overseas competitors].”

To drum up support for the Act’s passage, the estimated figure the RCEF would make available for our rice farmers would be a whopping Php10 billion a year. Then Senate President Pro-Tempore Ralph Recto promised that “all duties” collected from the RTL will given back to farmers “through a raft of assistance in the form of equipment, insurance, credit, and even direct financial aid.”

The Department of Finance (DOF), in a sponsored article with GMA News, promoted the RTL by promising it will make rice “affordable for all Filipinos.” Their colleagues at the Department of Agriculture (DA) blamed the QR measure under the Agricultural Tariffication Act for keeping the price of palay (unhusked rice) in the market “artificially high“.

When the RTL was being deliberated in the Houses of Congress, the Bangko Sentral ng Pilipinas (BSP) predicted that the measure would slash rice prices by Php7 per kilo – at that time, the average retail price of the staple was only Php46 per kilo. Not only did the promises of the RTL as promoted by the BSP and other various government agencies not come to fruition, the liberalization of rice imports has also failed to stymie the rising cost of the country’s main staple.

The Philippines surpassed China as the world’s biggest rice importer in 2023 and is projected to repeat that feat this year as well. Despite flooding the market with cheap rice imports, Filipinos are still paying more to buy rice.

An analysis conducted by the Philippine Institute for Development Studies (PIDS), a local think-tank, found that while rice prices continue to be high, Filipino rice farmers have become poorer.

With the RTL, the average farm gate palay price continued to fall translating to lower revenues for our domestic rice farmers. Between March 2019–February 2020 and March 2018–February 2019, palay prices dropped by 21.3 percent, equivalent to a loss of PHP 66.5 billion to farmers.

It should be noted that under the RTL, the RCEF was projected to earn approximately Php60 billion in six years (Php10 billion per year until 2024) which would then be used to help local rice farmers. However, with the loss projected by the PIDS our farmers have already lost more over two years than what they stood to have benefited from rice liberalization in six years.

Five years on from the creation of the Rice Tariffication Law, rice prices continue to be high; Filipino rice farmers have become less competitive in a domestic market flooded with cheap rice imports; and the Philippines – despite being an agricultural country – has become more dependent on imports to sustain its citizens’ demand for rice.

The legacy of the RTL is one of broken promises; it was pledged to be an answer to our country’s perpetual rice woes, but has only made things worse: not just for consumers in terms of retail prices, but has decimated our own rice industry as well. Because of the RTL, Filipino consumers are still paying high prices for rice – only now, our own Filipino farmers are suffering with them as well.

Such an ill-conceived legislation must not only be rectified, which is what the incumbent Marcos Jr. administration wants to do, it should be repealed entirely. Quantitative restrictions must be reinstated to protect our local farmers, while existing funds so far collected under the RCEF must be promptly disbursed to save our rapidly declining rice industry.